Back to top

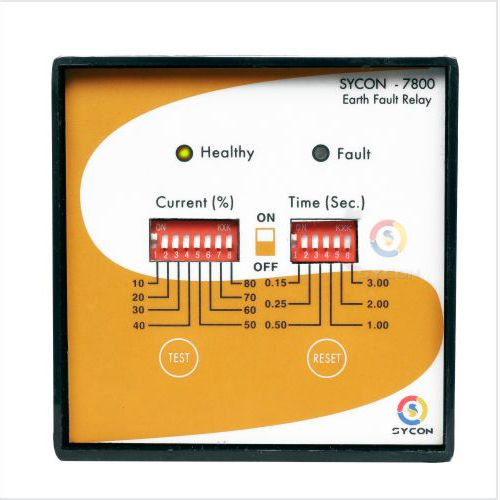

Hard-Wearing, Affordable and Reliable Maximum Demand Controller,

Protection Relay, Digital Panel Meter, Panel Accessories, Automatic

Power Factor Controller, etc.

Systems & Controls (SANGLI) Pvt. Ltd. is a key manufacturer and

supplier of high-quality maximum demand controllers, protection relays,

digital panel meters, panel accessories, automatic power factor

controllers, etc. In addition, we are also a reliable service provider

for the installation services of the offered products. The company was

incepted in 1988 by skilled directors who are postgraduates in the

engineering stream. We have been offering technically advanced and

productive products under the brand Sycon. We are an ISO

9001-2008-certified company working hard with a vision to install more

than 10,000 energy and water management solutions by 2025. We have been

offering matchless solutions with all the technical support and

customized products to enhance the plant's energy efficiency.

Why Choose Us?

Our Customers

Why Choose Us?

- More than 35 years of vast expertise and experience in the domain of power factor management solutions

- In-house R&D unit to design valuable products in tailored-made designs and dimensions.

- Customized products are available owing to a world-class manufacturing setup.

- End-to-end technical support is provided to solve pre-sale and post-sale queries quickly.

Our Customers

- BSNL

- Coca Cola

- Dainik Bhaskar

- GenSet

- ONGC

- TIME

- Kohler

- Jindal Power, etc.

Send Inquiry

Send Inquiry Call Me Free

Call Me Free